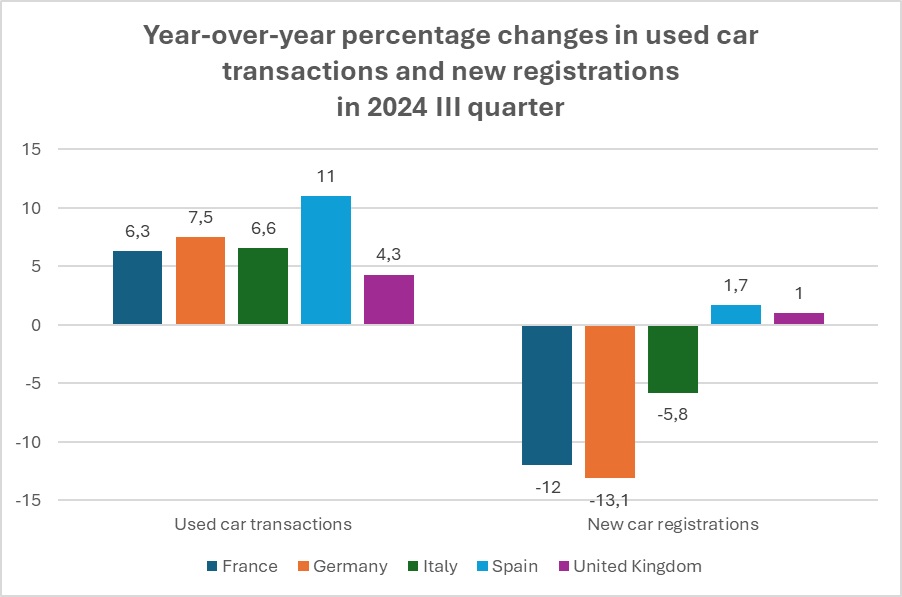

In the third quarter of 2024, Europe's largest used car markets – France, Germany, Italy, Spain, and the United Kingdom – maintained strong positions. This growth contrasted with the new car markets, which experienced a roller coaster throughout the year.

However, the used car sector might soon face a bumpy road. The new car market experienced a significant decline in 2022 due to supply chain issues, meaning fewer three-year-old models are likely to be available next year as fewer cars leave fleets. It remains to be seen whether transactions of older models will compensate for this shortage.

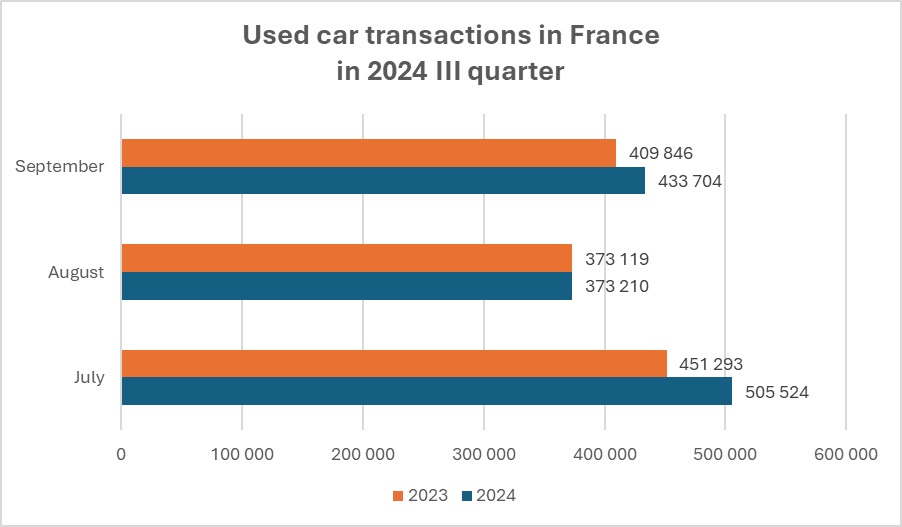

France

Used car transactions increased by 6.3% in the third quarter, reaching 1,312,438 transactions – the strongest market indicator so far this year. France showed solid results despite a slow August, with just a 0.02% growth. Strong results were achieved in July with a 12% growth, and a 5.8% increase in September. Used car sales contrasted with new car registrations, which dropped by 12%.

Notably, there was significant growth in the sales of used battery electric vehicles (BEV) in France. July saw a 124% increase, and strong growth continued in August and September with respective increases of 58% and 46%. Meanwhile, the new BEV market grew by only 1% in July, and then fell by 33.1% in August and 6.3% in September. This decline was caused by the imposition of EU tariffs on electric vehicles produced in China. Buyers likely shifted to used electric vehicles, which were more affordable. Additionally, since China-made electric vehicles are not eligible for subsidies in France, this also pushed consumers towards the used car market.

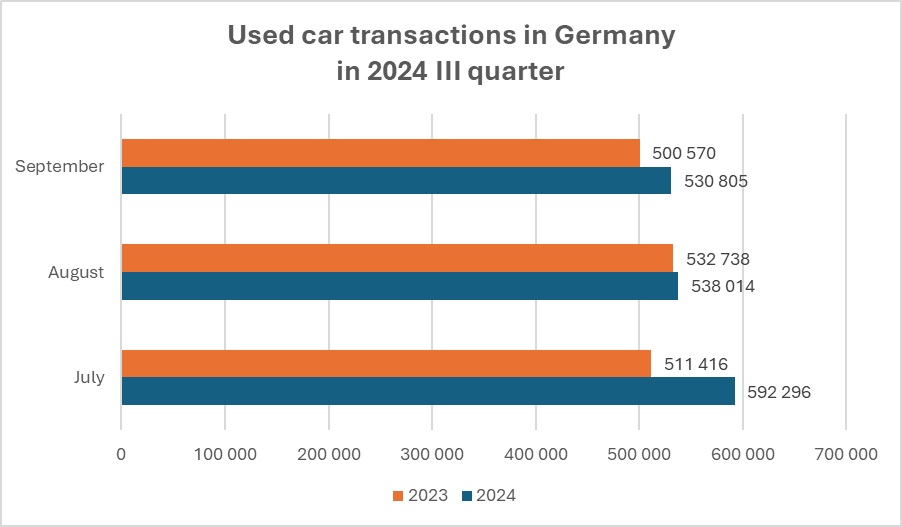

Germany

The used car market grew by 7.5% in Q3, with over 1.6 million transactions. Growth was recorded throughout the third quarter, with 15.8% in July, 1% in August, and 6% in September.

The new car market, on the other hand, struggled during the same period, with registrations dropping by 13.1% between July and September. Similar to France, this suggests that customers are interested in transitioning to electric vehicles, but not new ones. During the first nine months of 2024, the used car sector grew by 8.3%, reaching over 4.9 million transactions.

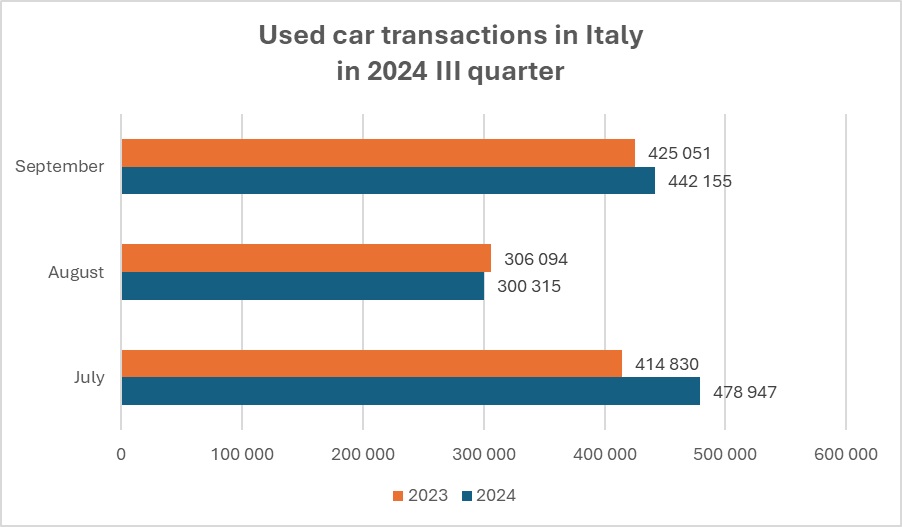

Italy

Growth was also recorded in Q3, but unlike other major markets, the road to a 6.6% quarterly increase was not smooth. The market started the quarter strong with a 15.5% increase in transactions in July, but saw a decline of 1.9% in August. In total, about 1.2 million cars changed owners.

In comparison, Italy's new car market fell by 5.8% during the same period. As a result, in the first nine months of the year, new registrations grew by 2.2%, while used car transactions increased by 8.1%.

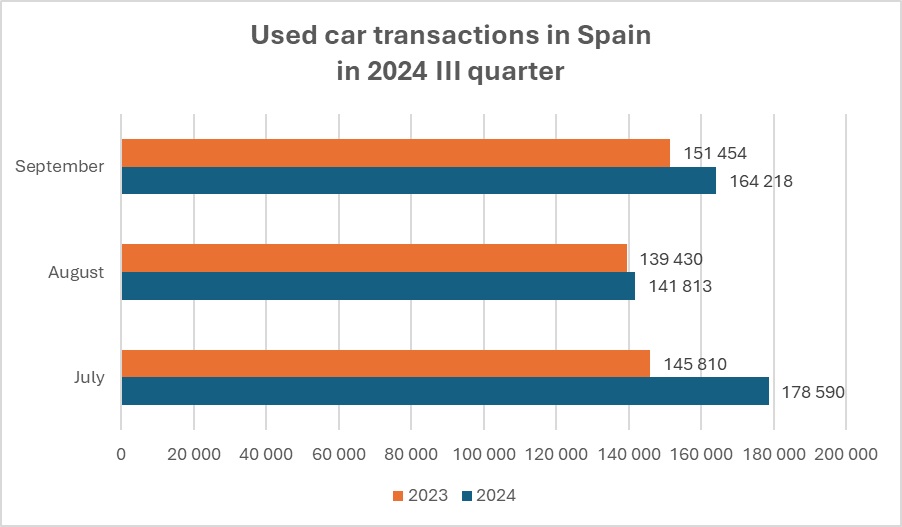

Spain

In terms of growth, Spain's used car market achieved the best results of all five markets. During Q3, the market grew by 11%, with 484,621 transactions. This result was supported by strong July figures, with a 22.5% increase. The used car market slowed in August, growing by only 1.7%, but ended the quarter strong with an 8.4% growth in September.

Over the first nine months, Spain's entire used car market grew by 8.6%, which was stronger than the new car market, which grew by 4.7% during the same period. However, Spain's new car sector remained stable throughout 2024, experiencing declines in registrations in only two of the nine months.

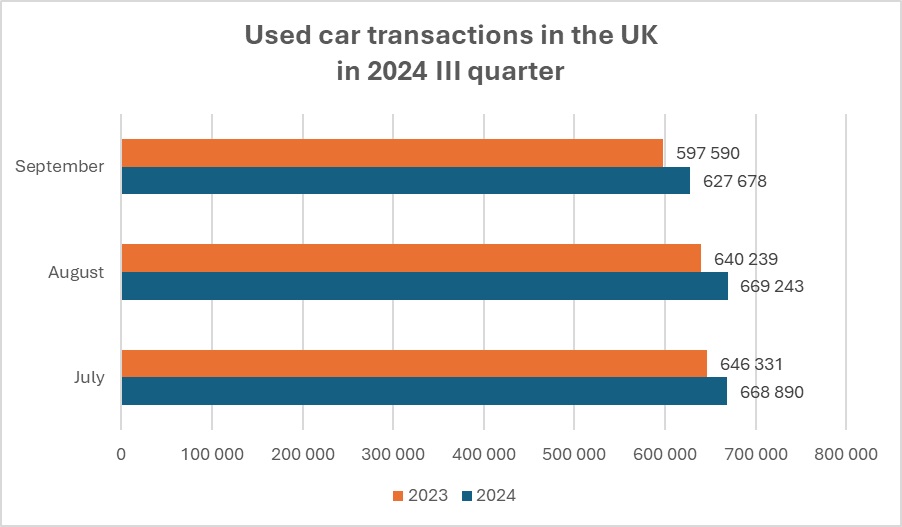

United Kingdom

Used car transactions increased by 4.3% in Q3, with almost 2 million transactions recorded, continuing the country's growth trend.

Unlike in France and Germany, the UK’s new car market remained stable throughout all three quarters of the year, with a slight 1.3% decrease in August and improving numbers for the second consecutive year. The used car market has continued to grow every month of 2024 from January to September, with a 6% increase, totaling nearly 5.9 million sales. The new car market grew by 4.3% during the same period.

Source: Autovista24