This article analyzes key indicators of the U.S. automotive market in 2024, including changes in wholesale and retail prices, inventory dynamics, and auction results.

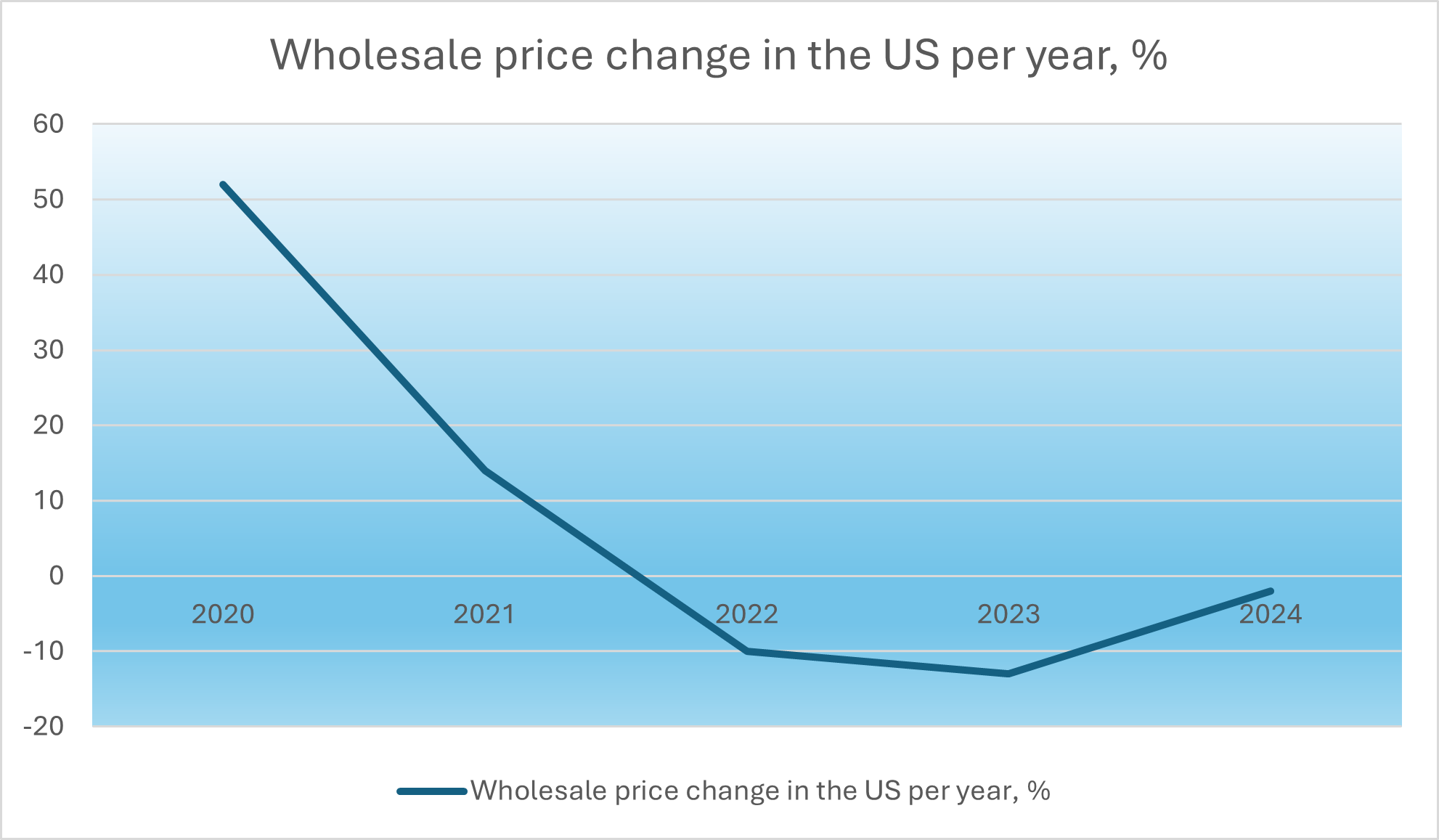

Weekly Wholesale Price Index 2020–2024

An analysis of price changes for 2–6-year-old vehicles in the U.S. shows that 2024 was marked by price stability. While minor fluctuations occurred during the year, they did not exceed 4% compared to the first week of the year, and by the end of the year, prices had dropped by only 2%. This indicates market stabilization. Meanwhile, wholesale prices decreased by 10% in 2023 and 13% in 2022. However, the price corrections in 2022–2023 did not offset the increases in 2020–2021, when wholesale prices rose by 52% and 14% respectively (due to supply chain disruptions caused by COVID-19 restrictions).

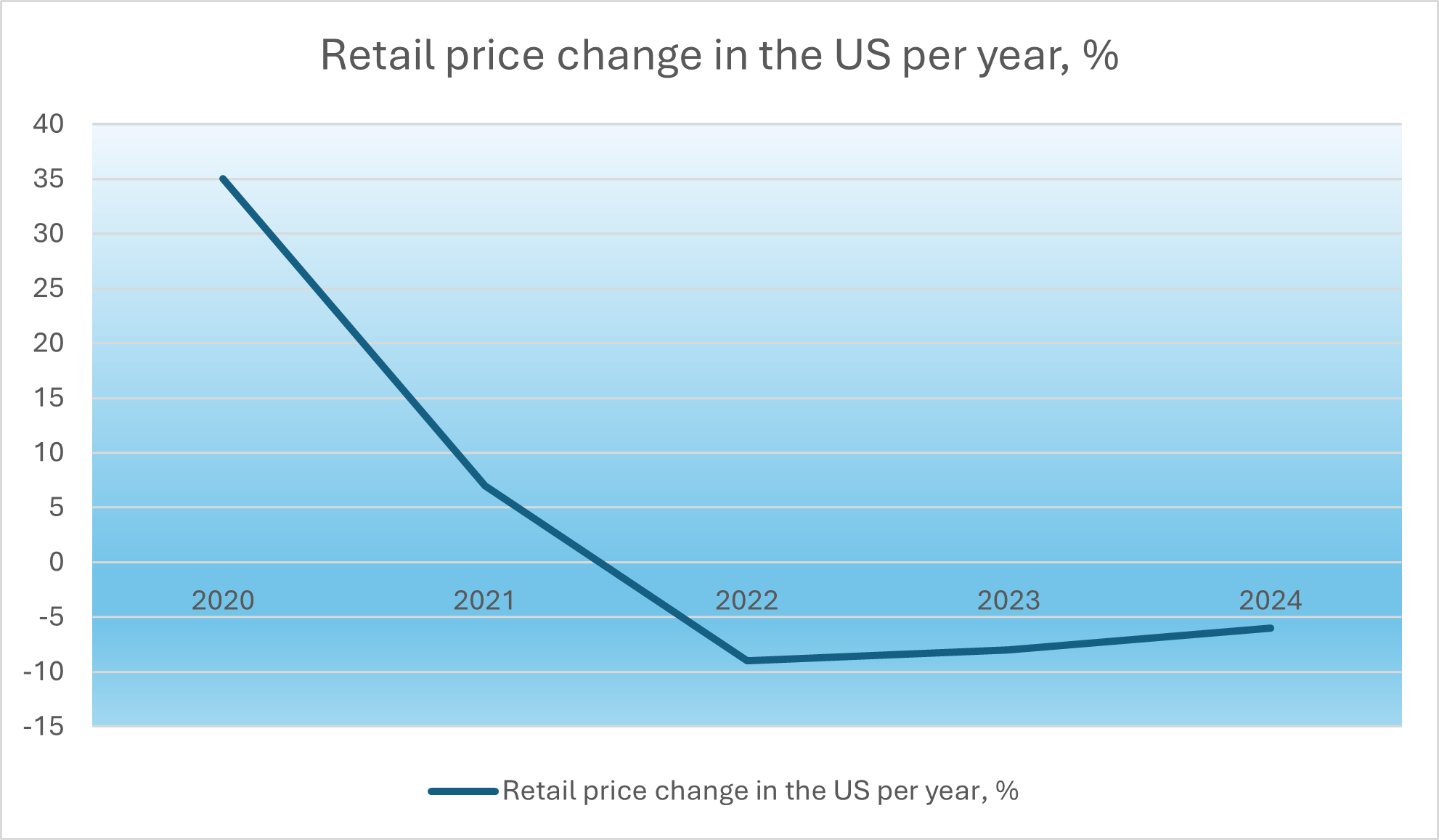

Weekly Retail Price Index 2020–2024

This analysis is based on 2 million listings from U.S. dealers. Retail price trends generally mirror wholesale price movements but differ in magnitude. Retail prices fell by 6% in 2024, 8% in 2023, and 9% in 2022. However, this three-year decline has yet to compensate for the price increases in 2020 and 2021, which rose by 35% and 7% respectively. Data suggests that as supply recovers, vehicle prices are gradually decreasing and becoming more favorable. Nonetheless, the price reductions still lag significantly behind the increases seen in 2020–2021.

Retail Inventory Levels

An analysis of inventory levels among independent and franchised dealers based on weekly movements shows that, despite a slight drop in the first quarter of 2024, inventory levels increased by 5% by the end of the year compared to the beginning. This reflects market stability. However, the average time a vehicle remains on sale grew from 38–40 days at the beginning of the year to 55 days by the end.

Wholesale Trading Conversion

Market stability is also evidenced by auction inventory levels in the U.S., which remained steady throughout 2024. The sales conversion rate also stayed consistent, ranging from 50% to 55%. This means that about half of the vehicles presented at auctions were sold.

Considering market stabilization and the downward pricing trends, 2025 could see an even more balanced market with more favorable prices for buyers.

Prepared based on Black Book data.