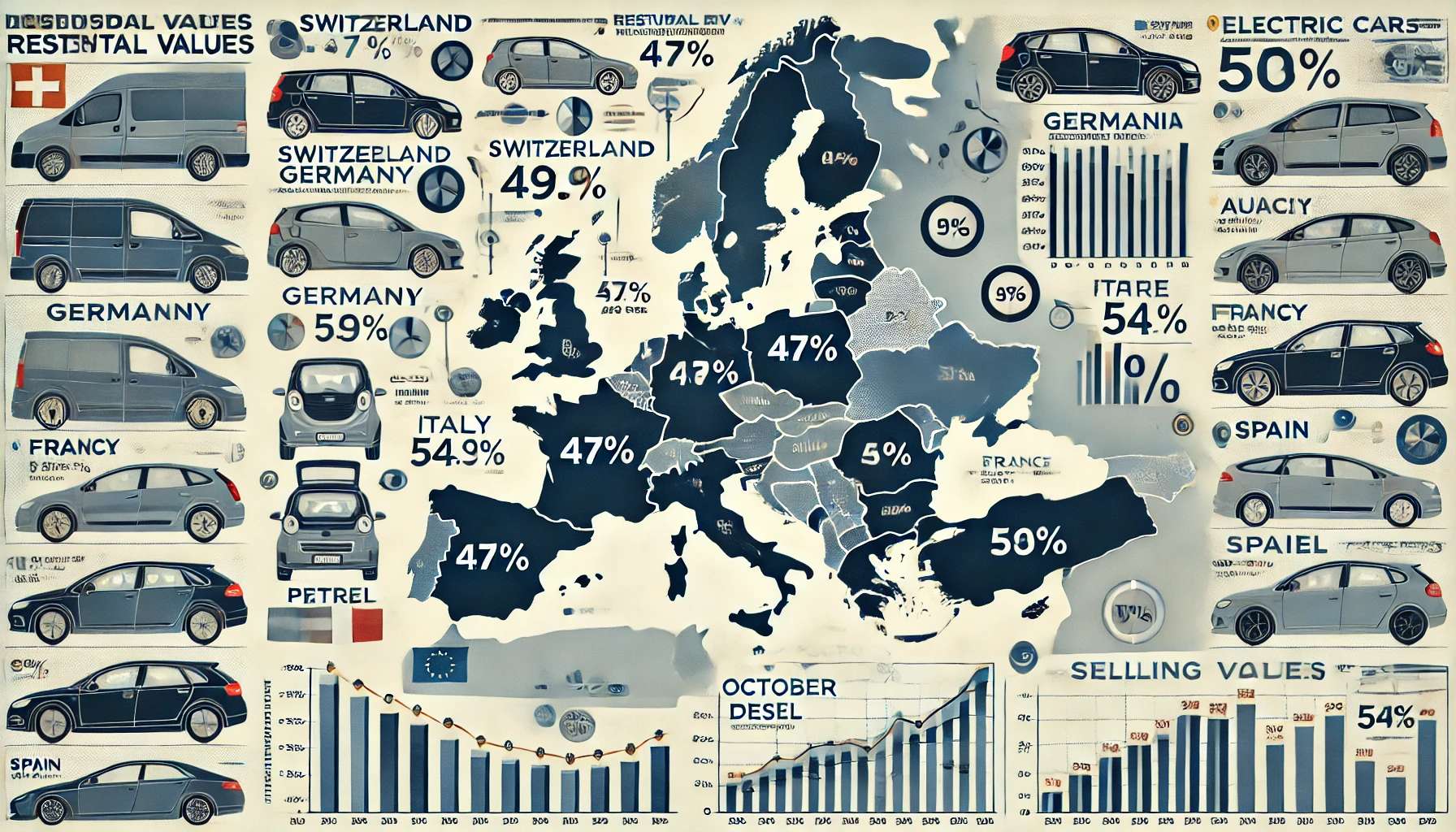

The residual values (%RV) of used cars in Europe continued to decline in October 2024, reflecting a normalization in the market after the extraordinary highs of the past few years. Here's an overview of the key trends and insights from major European markets:

1. General Market Trends

- Decline in Residual Values: Across Europe, the %RV of three-year-old cars at 60,000km hit record lows in many countries, signaling ongoing market adjustment.

- Demand-Supply Shifts: Pandemic-induced shortages and heightened demand had inflated values. As those pressures subside, %RVs are stabilizing.

- Weakening Demand: Consumer demand is not matching supply, pushing values lower, with further declines projected for 2024 and beyond.

2. Country-Specific Insights

Switzerland

- Current %RV: 47%, down from 50.1% YoY.

- Fastest-Selling Cars: Petrol (77.8 days), while BEVs took the longest (111.3 days).

- Forecast: %RVs to drop further due to stable supply and declining demand.

Germany

- Current %RV: 49.9%, down from 56.2% YoY.

- Fastest-Selling Cars: PHEVs (53 days), while BEVs struggled (66.3 days).

- Powertrain Leadership: HEVs lead with 53.3% retention.

- Trend: Declines expected to moderate in 2025 and 2026.

Austria

- Current %RV: 50%, down by 3.4pp YoY.

- Top Performer: HEVs (55.5%), while BEVs lagged (42.6%).

- Selling Time: Diesel sold fastest (54.5 days); BEVs slowest (85.1 days).

France

- Current %RV: 54.2%.

- Pressure on BEVs: Prices falling due to limited demand and high costs.

- Positive Trends: Stabilizing values and improving transactions.

Italy

- Current %RV: 50.3%, down from 54% YoY.

- List Prices Surge: Up 7.7% YoY to €38,419, straining %RV.

- LPG Performance: Only powertrain with YoY growth in %RV.

Spain

- Current %RV: 58.8%.

- Stability: Despite challenges, values remain relatively robust compared to other markets.

- Fastest-Selling Models: Mini Countryman, Volkswagen T-Roc.

UK

- Current %RV: 51.6%, down 0.7pp MoM and 7.8pp YoY.

- Diesel Resilience: Retained 52%, above market average.

- Market Balance: Stable supply-demand dynamics and consistent dealer activity.

3. Powertrain-Specific Insights

- HEVs: Consistently lead value retention across most markets.

- Diesels: Still popular with used-car buyers despite declining favor in the new-car market.

- BEVs: Struggle with the lowest %RVs due to limited demand and higher costs.

- PHEVs: Moderate performance but challenged by high prices and limited demand.

Outlook

While residual values are falling, this correction reflects a normalization after unprecedented peaks. The decline is expected to moderate in the coming years as supply stabilizes and markets adjust to evolving consumer preferences, particularly regarding electrified powertrains.

Source: Autovista24