Autovista Group data shows that used car sales across Europe significantly accelerated in March. However, this trend didn’t affect all powertrain types equally. This article reviews how different powertrain types performed in key European markets.

Sales Speed Increases, But Not Evenly

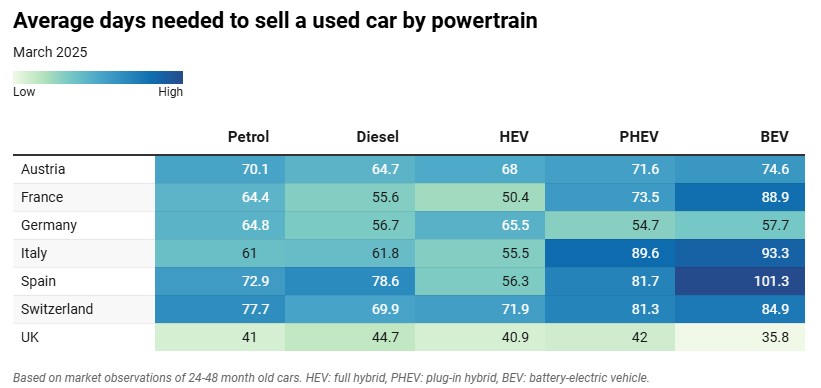

In March, 2–4-year-old vehicles sold faster than in February. Austria stood out — stock days decreased by as much as 6.3 days. The UK, Spain, and Switzerland also showed strong momentum, with respective improvements of 5.6, 4.9, and 4.8 days. Meanwhile, Germany and Italy recorded more modest gains (3.5 and 0.4 days), while France even saw a slight increase in selling time — by 0.2 days.

Electric Vehicles – The Slowest Sellers, Except in the UK

In Austria, France, Italy, Spain, and Switzerland, BEV (Battery Electric Vehicles) were the slowest-selling powertrain type. Rapid technological progress quickly “ages” used BEVs, while the lack of charging infrastructure suppresses demand. ICE (Internal Combustion Engine) vehicles are still seen as a more convenient refueling option.

The exception is the United Kingdom, where BEVs were the fastest-selling powertrain. Due to low residual values, some buyers actively sought attractive deals.

Hybrids Dominate – Both PHEVs and HEVs

Hybrid technology was the most in-demand in March across many markets — France, Germany, Italy, and Spain. These vehicles combine the convenience of ICEs with better fuel economy, making them clearly desirable in the used car market.

Austria: Diesel Vehicles Lead Sales

The average selling time for used cars in Austria dropped to 68.6 days. Diesel vehicles sold in 64.7 days, while BEVs took 74.6 days. Residual values also declined — the average RV in March stood at 48.3%. HEVs retained the highest value (52.5%), BEVs the lowest (44.1%).

France: Stable Market, But PHEVs Are Slowing Down

RV percentages remained stable, even rising for some powertrains. Diesel vehicles and HEVs remain the fastest-selling. PHEVs continue to suffer from oversupply. The BEV segment stagnates due to subsidy changes and high prices.

Germany: Weak Demand, But Prices Still Hold

Used car selling time decreased to 60.6 days. PHEVs were the fastest-selling (54.7 days), HEVs the slowest (65.5 days). RV percentages remained stable, but BEVs showed the lowest values — 37.6%. A 2.4% value decline is forecast for 2025.

Italy: Worsening Downturn Forecast

RV percentages in Italy continued to decline — in March, they dropped to 48.8%. Even HEVs saw a dip, although demand remains. The fastest-selling models were the Dacia Sandero and Duster (19.2 and 26.5 days, respectively). LPG vehicles were also selling very quickly (41.6 days).

Spain: More Younger Used Cars

The new car market is growing (+11% in February), partly due to government aid for flood victims. The used car market is also expanding, with a growing supply of younger vehicles — especially from the rental sector. Prices remain stable. Fastest-selling models include the DS7 Crossback, Toyota CH-R, and VW Polo.

Switzerland: Steady Supply, Declining Values

Used car supply remains steady, but RV percentages are falling — averaging 44.1% in March. Diesel vehicles sold the fastest (69.9 days), BEVs the slowest (84.9 days), although BEV selling times improved compared to February. Further, albeit slower, value decline is expected.

UK: Positive BEV Sales Stand Out

Used cars sold in an average of 40.7 days — 5.6 days faster than in February. BEVs were the fastest-selling powertrain (35.8 days), diesels the slowest (44.7 days). Although BEV RVs were only 39%, the monetary gap from the market average was minor (~£148).

Conclusion

Europe’s used car market is recovering, but the distribution across powertrain types remains uneven. Hybrids currently dominate in many countries, while BEVs remain a challenging category — despite success in the UK, elsewhere they face obstacles related to price, infrastructure, and value retention.

Source: Autovista24